Learning Slides

Introduction

This chapter deals with the concepts of income tax. However, for this course we will only cover on the topic of personal income tax. By the end of this chapter, student should be able to:

- identify allowance deductions for income tax purposes,

- determine chargeable income,

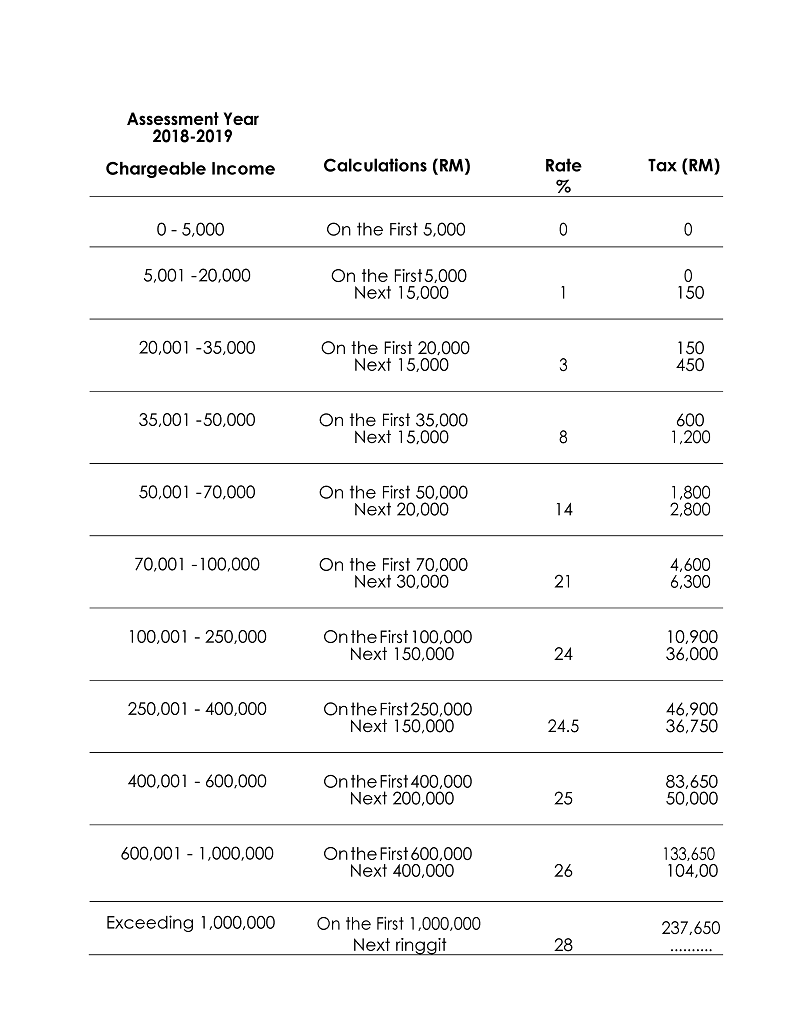

- use the tax schedule to determine the tax amount,

- recognize that tax rebate is allowed for a chargeable income of less than RM35,000 and that zakat is an allowable rebate, and

- calculate tax payable.

Type of Assessment

Income tax is the normal tax which is paid on your taxable (chargeable) income.

Two types of Assessment:

- Separate Assessment, such that:

- Tax is calculated individually. For instance : bachelor, husband only, wife only.

- Husband the only one working (wife get relief and rebate).

- Children are assessed under husband unless it is requested by wife.

- Tax is calculated individually. For instance : bachelor, husband only, wife only.

- Joint Assessment, such that:

- Tax is calculated together. For instance : husband + wife.

- For Parents Medical Expenses, only husband part is calculated.

- Tax is calculated together. For instance : husband + wife.

How to calculate tax payable amount?

To calculate tax payable amount, there are 5 steps:

1. Aggregate Income

- Annual Income (the salary for 12 months)

- For joint assessment, the aggregate income must be the combination income of husband and wife.

2. Donation

| Contribution | Amount |

|---|---|

| Gift of money to the Government, State Government or Local Authorities. | NIL |

| Gift of money to Approved Institutions or Organisations. | (Amount is limited to 7% of aggregate income) |

| Gift of money or cost of contribution in kind for any Approved Sports Activity or Sports Body. | (Amount is limited to 7% of aggregate income) |

| Gift of money or cost of contribution in kind for any Approved Project of National Interest Approved by Ministry of Finance. | (Amount is limited to 7% of aggregate income) |

| Gift of artifacts, manuscripts or paintings. | NIL |

| Gift of money for provision of Library Facilities or to Libraries | NIL |

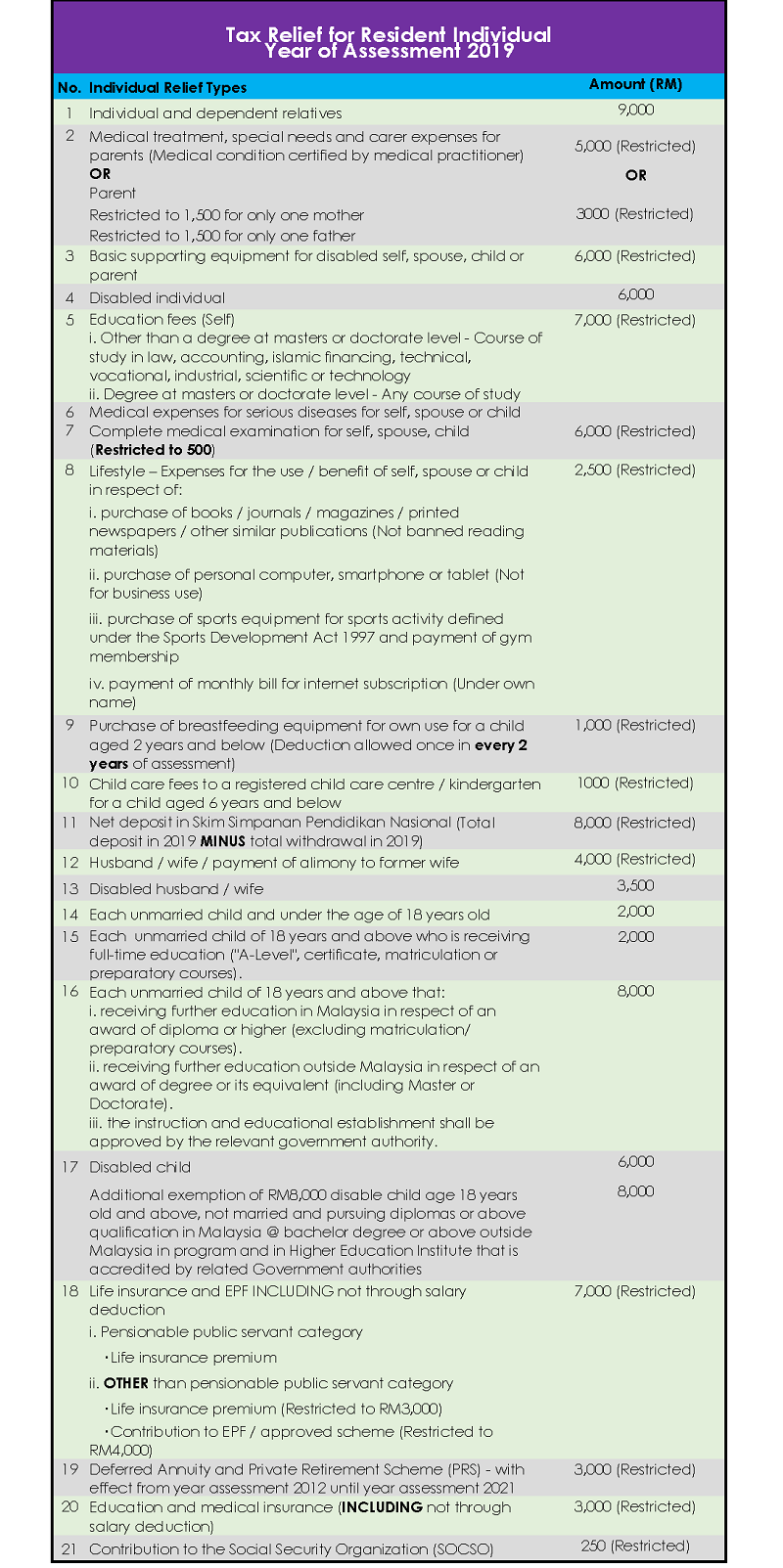

3. Reliefs

4. Taxable Income (Chargeable Income)

5. Rebates

| No. | Tax Rebates | Amount (RM) |

|---|---|---|

| 1. | Husband (Taxable income below RM35,000) | 400 |

| 2. | Wife (Taxable income below RM35,000) | 400 |

| 3. | Zakat | No Limit |

Solved Examples

Tax assessment for individual who is single

Tax assessment for individual who is married

Separate Assessment

Joint Assessment